Blog

Back

Back

Collateral-free Loan Lenders’ in India

Most students choose education loans, but not all have a positive experience borrowing and repaying them. This is primarily due to the poor service they receive during the process. The requirement of collateral and the fleecing mentality of lenders in India are two primary culprits in making your loan-purchasing experience unpleasant.

Let’s take a closer look at each of these lending players and the various challenges faced when seeking loans from them:

India Leanders-

Indian lenders are dominated by two major players viz. Banks and Non-Banking Financial Company (NBFC). All banks have a strict policy of lending amounts based on collateral, whereas NBFCs offer loans with no security.

The biggest problem with Indian lenders (both banks and NBFCs) is their inability to lend the entire loan amount to students. They only provide up to 40 lakhs, which often does not even cover the total cost of attendance at many universities.

Why should you choose Kuhoo student loan over other lenders

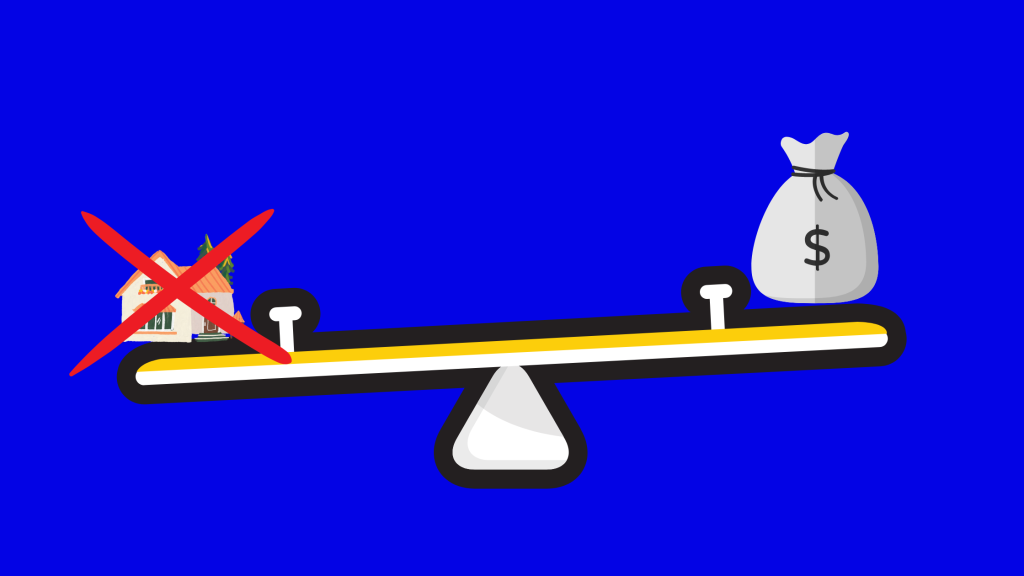

Collateral-free loan-

In comparison to Indian lenders, Kuhoo offers you the entire loan amount without the need for collateral. This is highly beneficial to low-income borrowers who do not have the luxury of collateral or a co-signer.

Providing complete financial support for the loan-

Kuhoo student loan outperforms Indian and international lenders by approving the entire loan amount rather than a portion of it, as is the norm with Indian and international lenders.

Non-requirement of Credit score-

Kuhoo student loan operates from India, so it has a better understanding of high-potential customers and can better assess the risk of lending to borrowers.

Quick Loan disbursement-

Following the approval of your application, the Kuhoo student loan is immediately credited to your account. However, the loan amount is immediately credited to the institution’s account when it comes to student loans. You may claim any remaining funds, if any, to pay for ancillary costs after the university has collected the overdue fee.

Edu fintech companies like Kuhoo provide collateral-free, completely digitized loans for upskilling or higher education with flexible repayment options. At Kuhoo, we strive to achieve an Atmanirbhar Bharat every day by helping the nation’s students become financially independent.