We are experts in the realm of student loans in India. Our experience allows us to create a reliable product and a hassle-free experience.

Our focus is entirely on students and their financial situation. You are our bread, butter, idly, dosa, poha, etc. and will get our undivided attention.

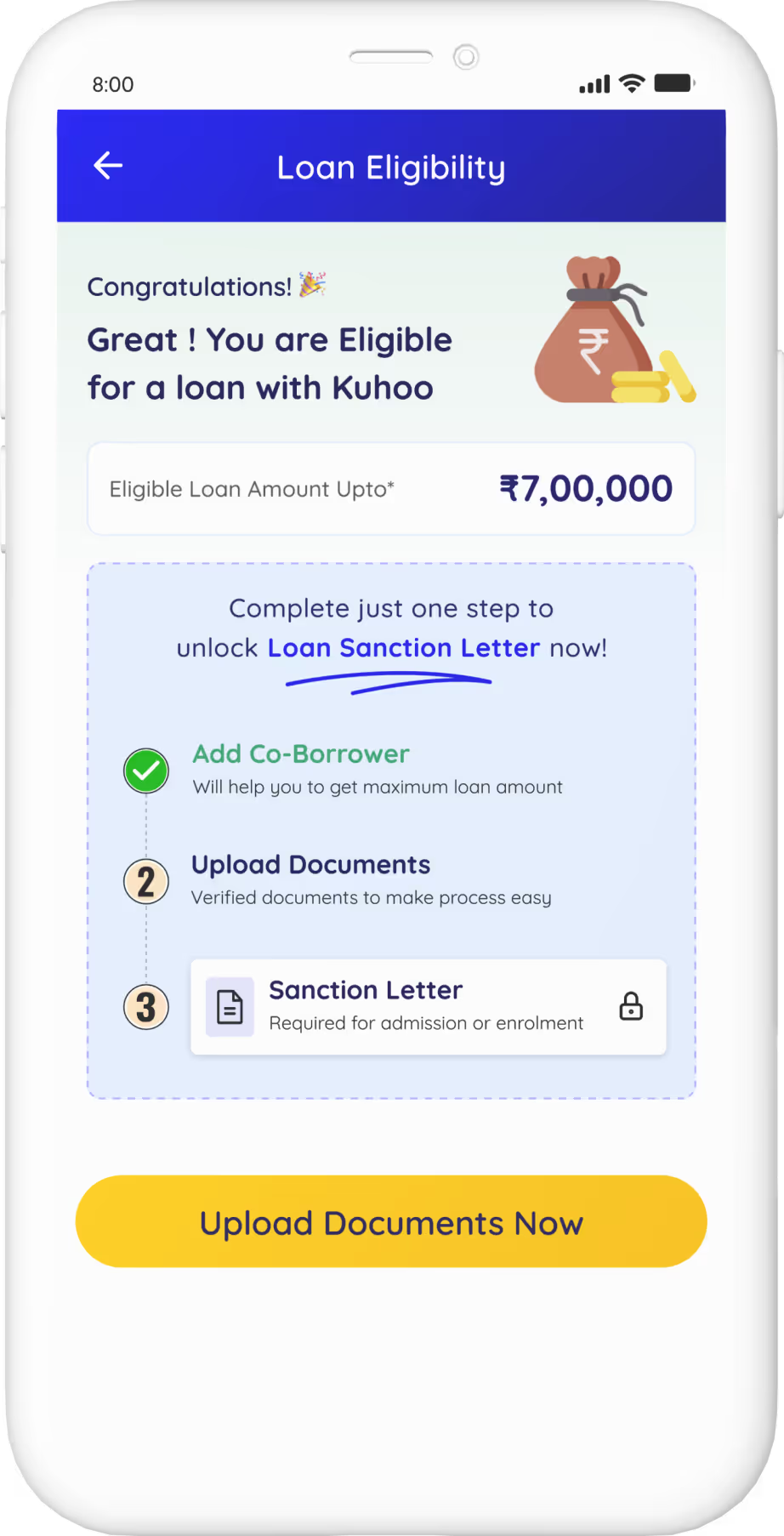

We offer an entirely student driven product which is independent of both co borrower and collateral.

Apart from tuition fees we offer support for living expenses as well. We offer a complete digital process for faster loan processing.